"Arrivederci" (arrividerci)

"Arrivederci" (arrividerci)

04/08/2016 at 08:33 ē Filed to: Tesla, EV, Federal Tax Credit, Model 3

2

2

0

0

"Arrivederci" (arrividerci)

"Arrivederci" (arrividerci)

04/08/2016 at 08:33 ē Filed to: Tesla, EV, Federal Tax Credit, Model 3 |  2 2

|  0 0 |

There has been much misinformation floating around about the Plug-In Electric Drive Vehicle Credit, U.S. Code ß 30D - how it works, how the credit is applied, who qualifies, the amount, the phase out period, and so on. Before reading my explanation, if you want, you can read the IRS explanation

!!!error: Indecipherable SUB-paragraph formatting!!!

and the law itself

!!!error: Indecipherable SUB-paragraph formatting!!!

.

As that is written, any EV from the major manufacturers will easily qualify for the full amount. However, the largest misconception stems from the number of cars that qualify for the tax credit, which is 200,000 from each manufacturer.

Iím going to try and frame this explanation with Tesla as my example, largely because theyíre the most likely manufacturer to hit the ďlimitĒ first.

Currently, Tesla has sold approximately 125,000 vehicles worldwide. Roughly 65,000 of those are sales in the United States ( !!!error: Indecipherable SUB-paragraph formatting!!! ). Now, letís assume that Tesla more than doubles their US sales total before the end of 2017, when the Model 3 is said to begin delivery, and have now sold 150,000 qualifying EVs. That would mean once the Model 3 is available, only 50,000 cars will be deliverable before the tax credit phaseout period begins.

Again, that 200,000 sounds like a limit, but is actually not. Consider the statement within the description of the phaseout period:

(2) Phaseout period

For purposes of this subsection, the phaseout period is the period beginning with the second calendar quarter following the calendar quarter which includes the first date on which the number of new qualified plug-in electric drive motor vehicles manufactured by the manufacturer of the vehicle referred to in paragraph (1) sold for use in the United States after December 31, 2009, is at least 200,000.

(3) Applicable percentage

For purposes of paragraph (1), the applicable percentage isó

(A)

50 percent for the first 2 calendar quarters of the phaseout period,

(B)

25 percent for the 3d and 4th calendar quarters of the phaseout period, and

(C)

0 percent for each calendar quarter thereafter.

This part is

huge

. The above description states that ďthe phaseout period is the period beginning with the second calendar quarter following the calendar quarter which includes the first date on which the number of new qualified plug-in electric drive motor vehicles manufactured... is at least 200,000.Ē

Qualified vehicles are only those which are sold to a US taxpayer for original use and not for resale. Cars manufactured here and sold abroad do not count towards the total.

As described, the phaseout period does not begin until the second quarter after the 200,000th qualifying vehicle is sold in the US. Back to our assumption that Tesla will sell 150,000 vehicles by the time the Model 3 is launched, letís next assume that Tesla will hit vehicle 200,000 sometime in early to mid 2018 as most publications generally assume.

If qualifying vehicle 200,000 is sold on the first day of Q2 2018, that means every vehicle Tesla sells in Q2 2018

and

Q3 2018 will qualify for the full $7500 federal tax credit, regardless of number sold.

In response to a tweet about suggesting Tesla slow US deliveries to enable such a scenario, Elon Musk replied:

We always try to maximize customer happiness even if that means a revenue shortfall in a quarter. Loyalty begets loyalty

Most assume this to mean that Tesla will try and game the system to ensure the largest potential opportunity for Model 3 buyers to qualify for the full credit. If

!!!error: Indecipherable SUB-paragraph formatting!!!

is reached for that six-month period that could be as many as an additional 240,000 vehicles qualifying. Even if Tesla is only at 20% of that capacity, thatís an additional 48,000 qualifying vehicles. As you can see, 200,000 isnít a hard stop and could even be a total thatís nearly doubled.

Another item many articles havenít mentioned is that the credit doesnít disappear, itís actually phased out. In our example, once Q3 2018 ends, the credit will be cut in half, to $3750 and will be available for all qualifying vehicles sold by Tesla for Q4 2018 and Q1 2019. The final period of the phaseout in our example will be Q2 2019 and Q3 2019 where the credit be cut in half again to $1875 for all qualifying vehicles sold in that period.

Of course, we must also consider that the Model S and Model X are still being produced, so they will continue to earn the credit as well, so the entire totals weíve discussed for tax credits will not all apply to the Model 3. However, it is safe to say that the potential exists for the bulk of US Model 3 buyers who have already placed a reservation to qualify for the full tax credit. I also believe that

all

US Model 3 buyers who have already placed a reservation will qualify for at least the $3750 or $1875 phaseout credit.

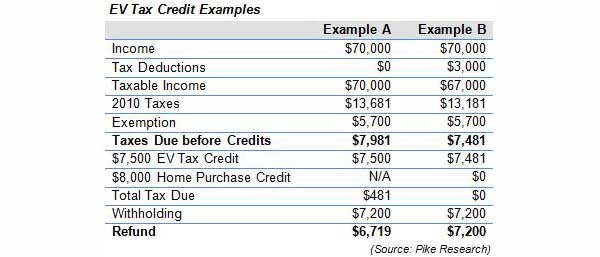

The next item of concern is who individually qualifies for the tax credit. Most folks Iíve encountered seem to think that all you have to do is get a qualifying vehicle to get the $7500. Thatís not entirely true. You have to have enough of a federal tax liability to get those funds back.

Consider the above example Iíve pilfered from Google Images. Example A has enough of a tax liability to qualify for the full $7500 credit. Example B only has a liability of $7481, so thatís all they get from the EV credit. If youíre making $15/hr and living at home and are counting on the full $7500 credit to help pay for your EV, your federal tax liability wonít even be close to netting you that full amount.

Now, what actually happens surrounding the production of the Model 3 and the scenario Iíve described above is really anybodyís guess. However, if Tesla is smart about it, theyíll do what they can to ensure as many buyers as possible qualify for the full credit, as it only means more profit (in both vehicle sales and/or options chosen) for them in the long run.

And now I can finally say it and mean it, Thanks Obama.